9/2/21 1099C Cancellation of Debt may be the most hated tax form around To ease the pain, here is the 1099C deadline and the 1099 C stat of limitations27/7/21 You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt Common examples of when you might receive a Form 1099C include repossession, foreclosure, return of property to a lender, abandonment of property, or the modification of a loan on your principal residence Mortgage forgiveness debt relief act24/3/21 File 1099C for canceled debt of $600 or more, if you are an applicable financial entity and an identifiable event has occurred File Form 1099C for each debtor for whom you canceled $600 or more of a debt owed to you if You are an applicable financial entity

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 nec form 2020 schedule c

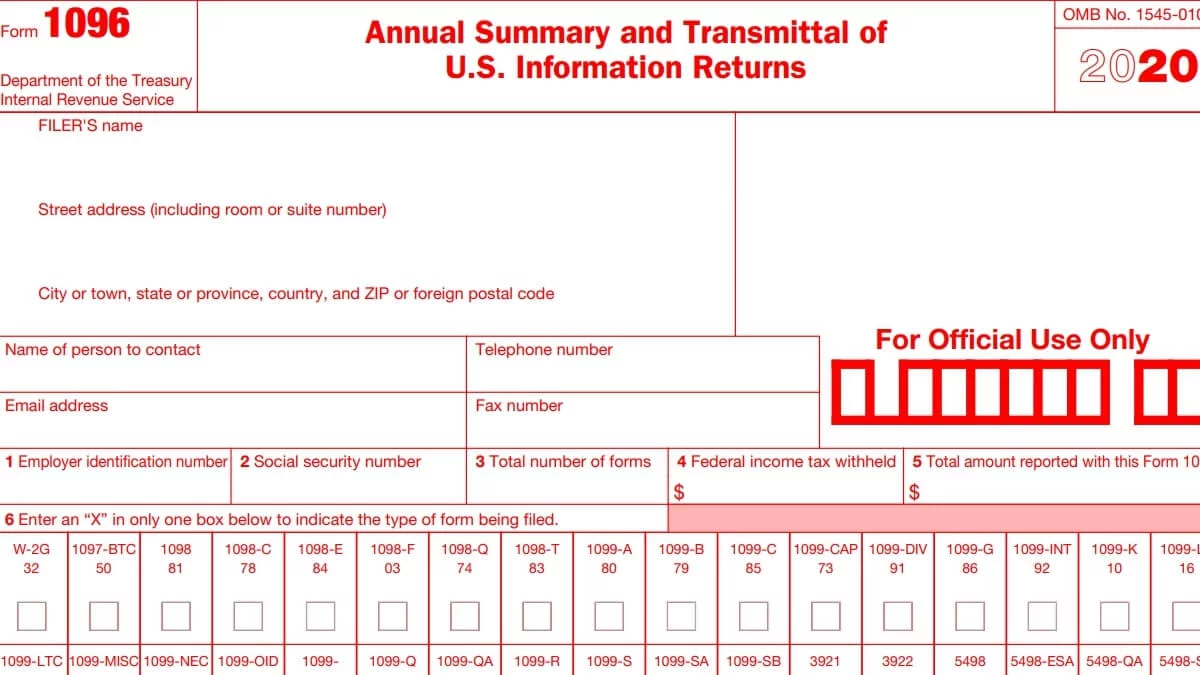

1099 nec form 2020 schedule c-Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAPStaples 1099MISC forms are used to report miscellaneous payments made to persons who are not your employee Payers must furnish 1099MISC forms to recipients on or before When filing using paper forms, you must file Copy A of Form 1099MISC with Form 1096 by

1099 C Carbonless 4 Part W 2taxforms Com

Website's listing 1099 form pdf August 21 1099 Form Printable Pdf 07/21 1099 Form Printable Pdf Overview 1099 Form Printable Pdf can offer you many choices to save money thanks to 13 active results You can get the best discount of up to 77% off The new discount codes are constantly updated on CouponxooIRS Form 1099C is used by creditors (including domestic bank, a trust company, a credit union) to report the cancellation of $600 or more in debt owed to the debtors such as an individual, corporation, partnership, trust, estate, association or companyFile 1099C Online with Tax1099 for easy and secure eFile 1099C form How to file 1099C instructions & due date IRS authorized eFile service provider for form 1099C

OnePieces, Overalls & Jum Uniforms Clothing Sets 1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC incomeForm 1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 9595 VOID CORRECTED

1099 Form Printable Pdf 07/21 1099 Form Printable Pdf Overview 1099 Form Printable Pdf can offer you many choices to save money thanks to 13 active results You can get the best discount of up to 77% off The new discount codes are constantly updated on Couponxoo The latest ones are onForm 1095C, EmployerProvided Health Insurance Offer and Coverage, reports whether your employer offered you health insurance coverage and information about what coverage was offered to you This form is for your information only and is not included in your tax return unless you purchased health insurance through the progress in addition to thisVery carefully confirm the content of the form as well as grammar along with punctuational Navigate to Support area when you have questions or perhaps handle our Assistance team Place an electronic digital unique in your Form 1099C by using Sign Device After the form is fully gone, media Completed

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

25/2/21 Many 1099C forms contain errors, and experts say it's one of the more confusing tax forms (See related story 1099C surprise IRS tax follows canceled debt ) But there are some rules, including an important one on timing Lenders that file a 1099 form with the IRS are required to send you a 1099C form by Jan 31Get 📝 1099 Form for 📝 Instructions, requirements, print form and more for every 1099 form type MISC, Employe, C Dept and all otherAccountant's Assistant The Accountant can help you with your 1099 Just to clarify, did you submit this form last year?

1099 C Form Copy C Creditor Discount Tax Forms

Irs 1099 C Form Pdffiller

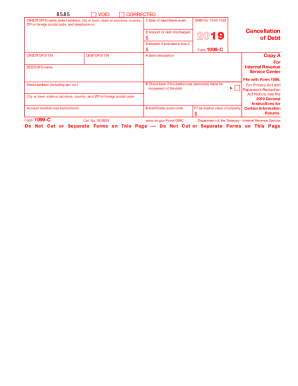

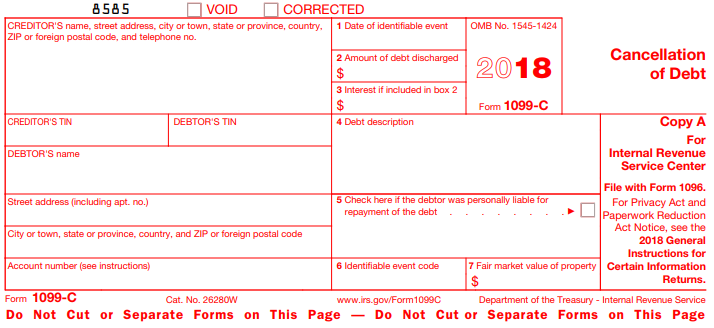

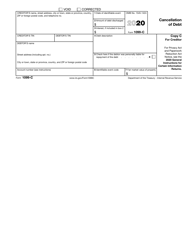

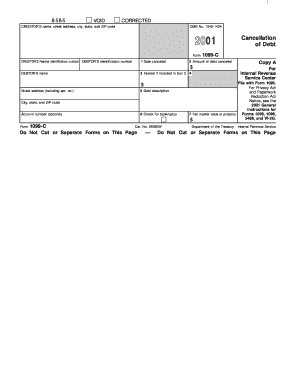

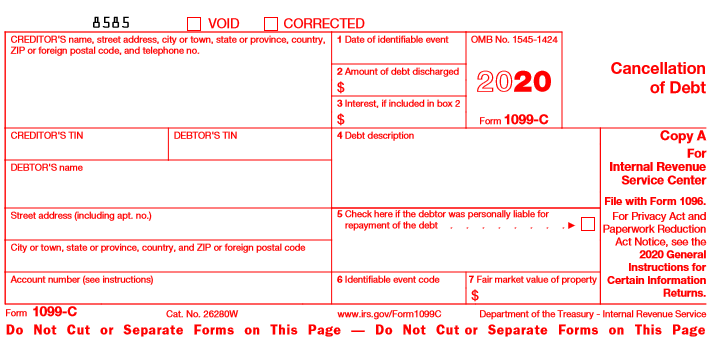

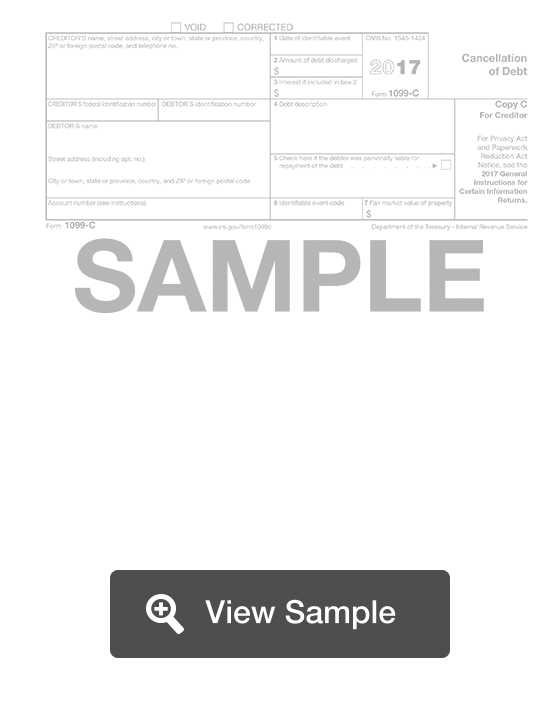

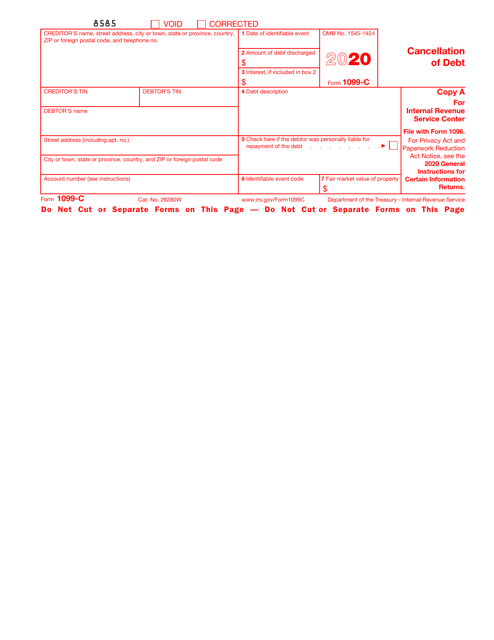

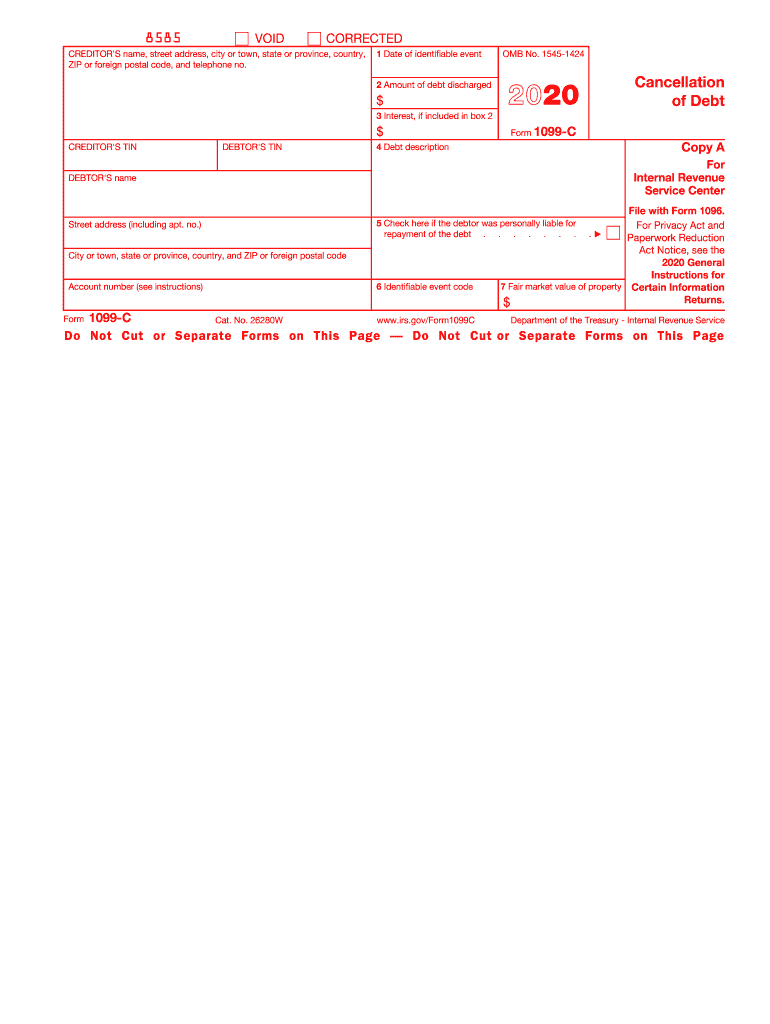

28/8/ The IRS has reintroduced Form 1099NEC as the new way to report selfemployment income instead of Form 1099MISC as traditionally had been used This was done to help clarify the separate filing deadlines on Form 1099MISC and the new 1099NEC form will be used starting with the tax year5/1/21 Form MA 1099HC Individual Mandate Massachusetts Health Care Coverage Massachusetts Department of Reve nue 1 Name of insurance company or administrator 2 FID number of insurance co or administratorCancellation of Debt (Info Copy Only) Form 1099C 8585 VOID CORRECTED CREDITOR'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no 1 Date of identifiable event 2 Amount of debt discharged $ 3 Interest, if included in box 2 $ CREDITOR'S TIN DEBTOR'S TIN OMB No Form 1099C Copy A 4 Debt

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

What Is Form 1099 Nec For Nonemployee Compensation

24/3/21 I'm trying to download my 1099 form and I searched a few of these discussions and saw that I can find this form under the Settings > Payments > Payouts tab but I don't see a 'documents' option to download when I got to export these payouts I also have not received an email from Shopify with a 1099 Form for but I can confirmForm 1099MISC IRS tax forms payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax If your net products on Schedule C (Form 1040 or 1040SR)8/6/ IRS 1099C Form 1099C Form IRS 1099C Instructions 1099C Instructions

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

I Just Got A 1099 C Form For A Debt From 16 Years Ago

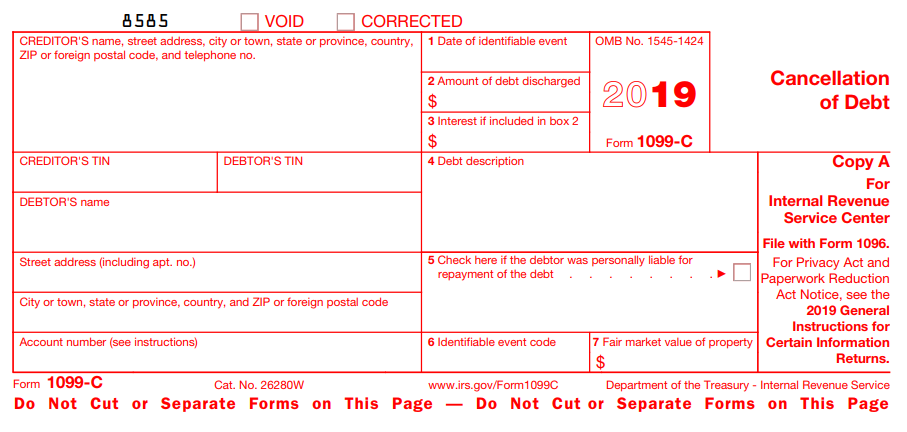

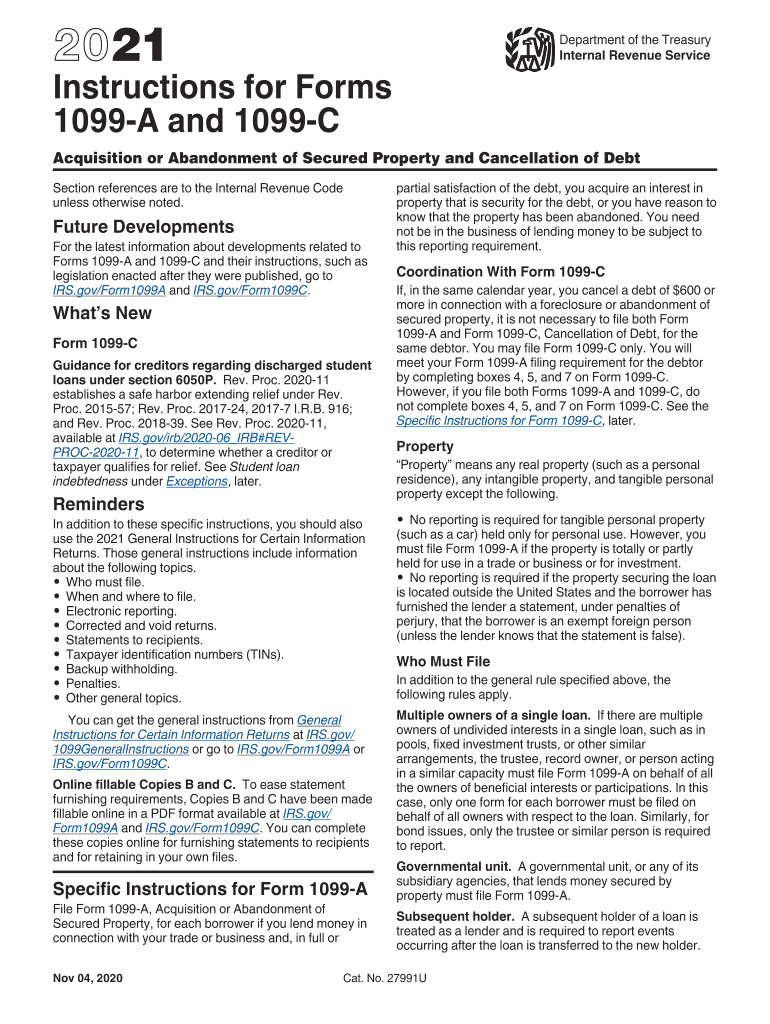

Printable Form 1099 C – One of the most significant and fundamental documents you have to have at all times is really a 1099 form It is a form that the IRS demands all companies to keep up It can be utilized by companies as an efficient way of filing their annual income tax returns3/8/21 Form 9 IRS Form 9 is more complicated than a 1099C If you or your tax consultant decide to exclude your debt forgiveness from income taxes, you must file Form 9 to detail your reason for exclusion You'll basically be telling the IRS, "Hey, this shouldn't be considered part of my gross income, and this is why"Forms 1099A and 1099C and their instructions, such as legislation enacted after they were published, go to IRSgov/Form1099A and IRSgov/Form1099C What's New Form 1099C Guidance for creditors regarding discharged student loans under section 6050P Rev Proc 11 establishes a safe harbor extending relief under Rev

1099 Misc Miscellaneous Income Payer Copy C 2up

1099 C 19 Public Documents 1099 Pro Wiki

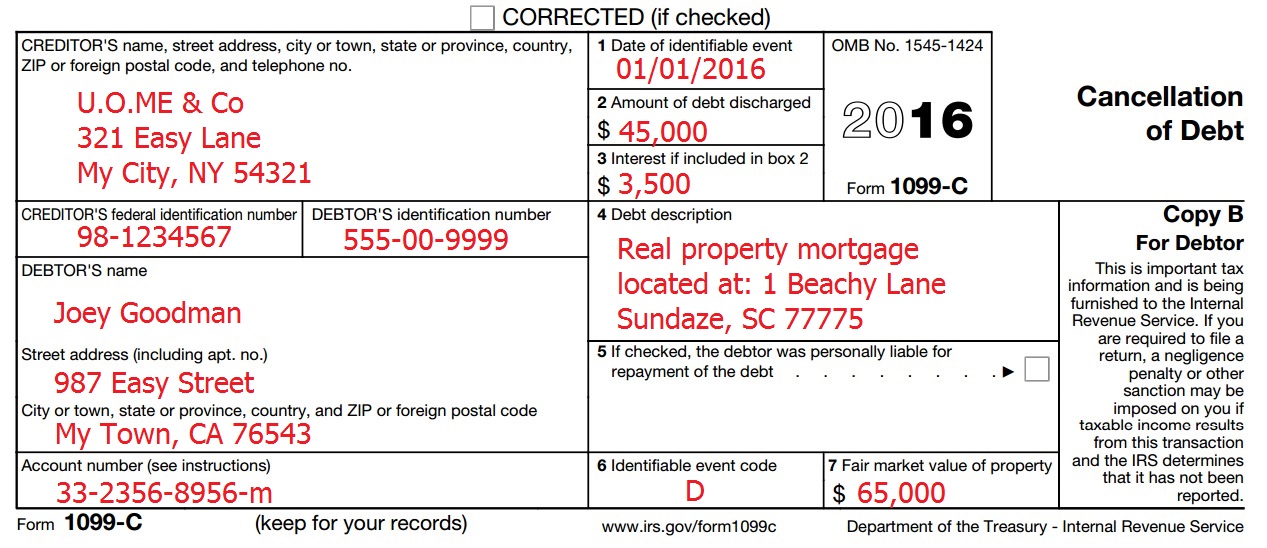

When you receive a 1099C form, file it somewhere safe—you're going to need it when you start filing your taxes If you work with a CPA or tax10/8/21 The 1099NEC form has replaced what used to be recorded on Form 1099MISC, Box 7 You will complete and send a 1099NEC form to any independent contractors or businesses to whom you paid over $600 in fees, commissions, prizes, awards, or other forms of compensation for services performed for your business4/5/21 The 1099C form is specifically used to report income related to cancellation of debt The IRS considers forgiven debt as income because you received a benefit without paying for it If you borrowed $10,000 and only paid back $4,000, for example, then at some point you ended up with an "income" of $6,000

Doordash 1099 Taxes And Write Offs Stride Blog

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

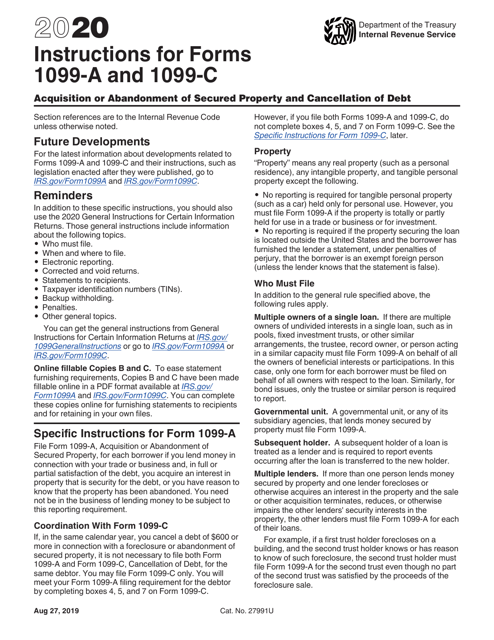

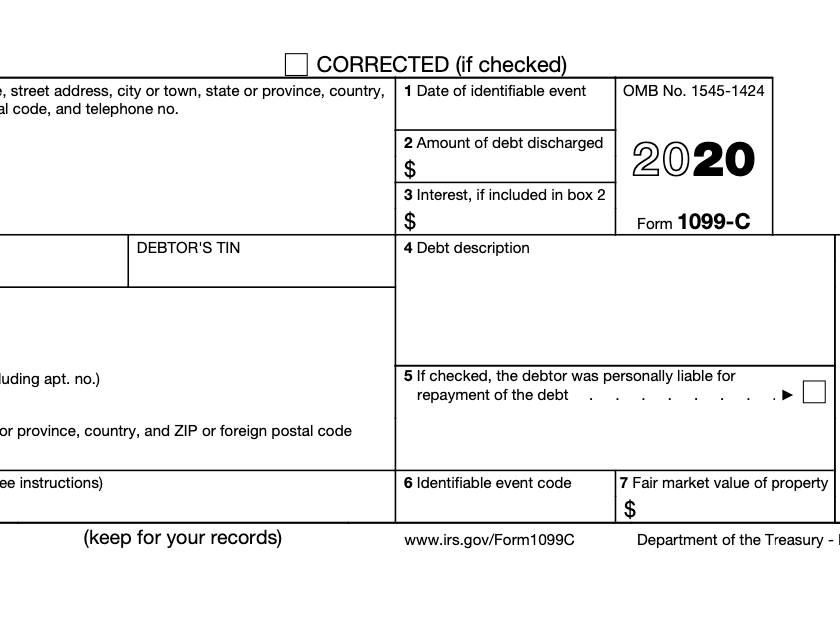

If you can't repay your debts, like credit card debt or a personal loan, it's possible that your lender might agree to settle for less than you owe or forgive your debt entirely This can bring a welcome sigh of relief — until you get a Form 1099C in the mail when it's time to do your taxesForm 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determinesInst 1099 General Instructions General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W2G) Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

What is the IRS Form 1099C?1099NEC You'll receive a 1099NEC (nonemployee compensation) for income you receive for contract labor or selfemployment Note Prior to tax year , this information was reported on Form 1099MISC with Box 7 checked If you work for more than one company, you'll receive a 1099 tax form from each companyEvery Essential Tip About IRS 1099 Form in Citizens use an online 1099 form for declaring nonemployment profit with Revenue Office This report is mandatory The Tax Service will check it with your annual informational return If you don't submit correct documents, the government will prosecute you for tax failure

File 1099 C Online E File 1099 C How To File 1099 C Form

1099 Nec Form Copy B C 2 3up Zbp Forms

Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only) 19 Form 1099CAP23/3/21 My father passed away in November of , I received a 1099C form in December of Do I have to include this form while doing his Indivdual Income Tax form or an estate tax form?Form 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses the form to report the canceled debt

1096 Form Irs Forms Zrivo

Official 1099 Forms At Lower Prices Zbpforms Com

Get form 1099 c cancellation of debt signed right from your smartphone using these six tips Type signnowcom in your phone's browser and log in to your account If you don't have an account yet, register Search for the document you need to electronically sign on your device and upload itPrintable 1099 C Form – One of the most significant and basic paperwork you must have all the time is a 1099 form It's a form that the IRS demands all businesses to maintain It can be used by companies being an effective method of submitting their yearly income tax returns16/4/09 Ask for a corrected 1099C form New for the tax year Thanks to the federal government's Consolidated Appropriations Act, which was signed into law on Dec 27, , taxpayers who've had mortgage debt forgiven might not have to pay taxes on it when filling out their income taxes this year

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

What Is A 1099 Form And Who Gets One Taxes Us News

1099 Software 1099 Printing Software, 1099 Efile Software Download 1099 Software Evaluation 1099C Forms * Cancellation of Debt Use this IRS form to report cancellation of a debt owed to a financial institution, the Federal Government, a credit union, RTC, FDIC, NCUA, a military department, the US Postal Service, the Postal Rate Commission, or any organization having a01 1099C form 8585 VOID CORRECTED CREDITOR S name, street address, city, state, and ZIP code OMB No FILL NOW10/5/21 El Formulario 1099C para cancelaciones de deuda A veces, las transacciones pueden aumentar tu ingreso tributable, incluso cuando no recibes ningún pago Este caso comúnmente se da cuando un acreedor cancela una porción de tu deuda pendiente

1099 C Defined Handling Past Due Debt Priortax

1099 C 18 Public Documents 1099 Pro Wiki

1/2/21 To complete Form 1099C, use The General Instructions for Certain Information Returns, and The Instructions for Forms 1099A and 1099CTo order these instructions and additional forms, go to wwwirsgov/Form1099C1099 C Fillable Form – If you are questioning what's a 1099 Form, this is the answer it is an essential instrument that can help the IRS to determine what your taxes had been for the year and how much money you owe towards the government The first factor that you simply need to comprehend is that there is no universal definition of what a 1099 is What is a Form 1099C?

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Irs Announces Form 1099 C Not Required For Ppp Loan Forgiveness Mcglinchey Stafford Pllc

Irs Form 1099 C And Canceled Debt Credit Karma Tax

Your Ultimate Guide To 1099s

1099 C What You Need To Know About This Irs Form The Motley Fool

Form 1099 Misc To Report Miscellaneous Income

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 Nec Form Copy C 2 Zbp Forms

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 C Debt Forgiven But Not Forgotten Credit Firm

What Do I Do With This Irs Cp00 Claim I Owe Tax On A Cancelled Debt Wake Forest News

What Is A 1099 Form Who S It For Debt Org

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Irs 1099 C Form Pdffiller

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

1099 C Form Copy A Federal Discount Tax Forms

What Is An Irs Schedule C Form And What You Need To Know About It

Form 1099 Nec For Nonemployee Compensation H R Block

About Form 1099 C Cancellation Of Debt Plianced Inc

Irs Form 9 Is Your Friend If You Got A 1099 C

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

3

1099 C Public Documents 1099 Pro Wiki

1099 C Form 21 1099 Forms Zrivo

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Form 1099 Misc Requirements Deadlines And Penalties Efile360

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

What Are Irs 1099 Forms

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

1

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

What Is A C Corporation What You Need To Know About C Corps Gusto

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

How To File Schedule C Form 1040 Bench Accounting

Irs Form 1099 C Software 79 Print 2 Efile 1099 C Software

Form 1099 C Faqs About Liability For Cancelled Debts Formswift

1099 C Carbonless 4 Part W 2taxforms Com

What Is A 1099 C And What To Do About It

1099 R Software To Create Print E File Irs Form 1099 R

When Is Canceled Debt Taxable Freedom Law Firm

Do I Need To File 1099s Deb Evans Tax Company

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 Misc Form Fillable Printable Download Free Instructions

1099 C Tax Form Copy B Laser W 2taxforms Com

1099 C Form Copy B Debtor Discount Tax Forms

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

1099 C Defined Handling Past Due Debt Priortax

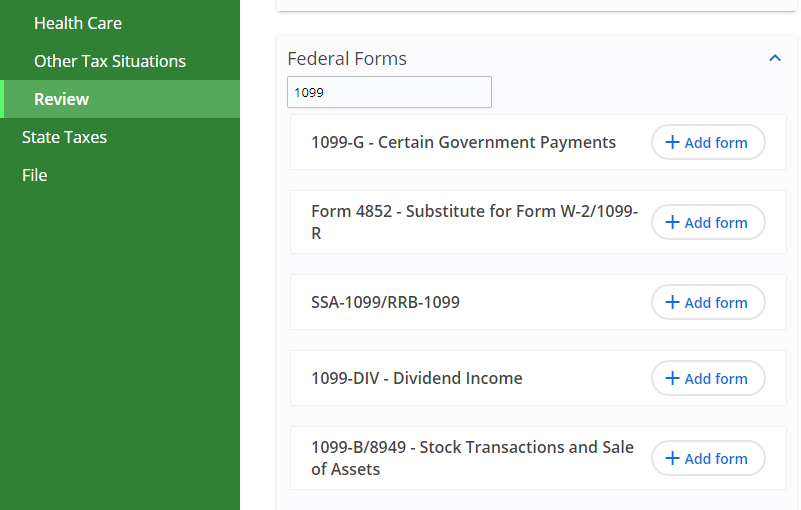

E File Form 1099 With Your 21 Online Tax Return

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

1096 Form 1099 Forms Taxuni

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Form Irs 1099 C Fill Online Printable Fillable Blank Pdffiller

What Are Irs 1099 Forms

What Does A 1099 C Cancellation Of Debt Mean

1099 Misc Form Fillable Printable Download Free Instructions

1099 C Cancellation Of Debt And Form 9

Instant Form 1099 Generator Create 1099 Easily Form Pros

Www Irs Gov Pub Irs Prior I1099ac Pdf

What Is A 1099 C Cancellation Of Debt Form Bankrate

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

pay05 Form 1099 C Cancellation Of Debt Copy C Creditor Greatland Com

1

3

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

All You Need To Know About The 1099 Form 21

Nec5112 2 Up 1099 Nec Laser Payer State Copy C Tax Form With Nec Non Employee Compensation New Form

1099nec Forms Zbp Forms

Walk Through Filing Taxes As An Independent Contractor

1099 C Tax Form Copy A Laser W 2taxforms Com

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

1099 Misc Form Copy B Recipient Discount Tax Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

0 件のコメント:

コメントを投稿