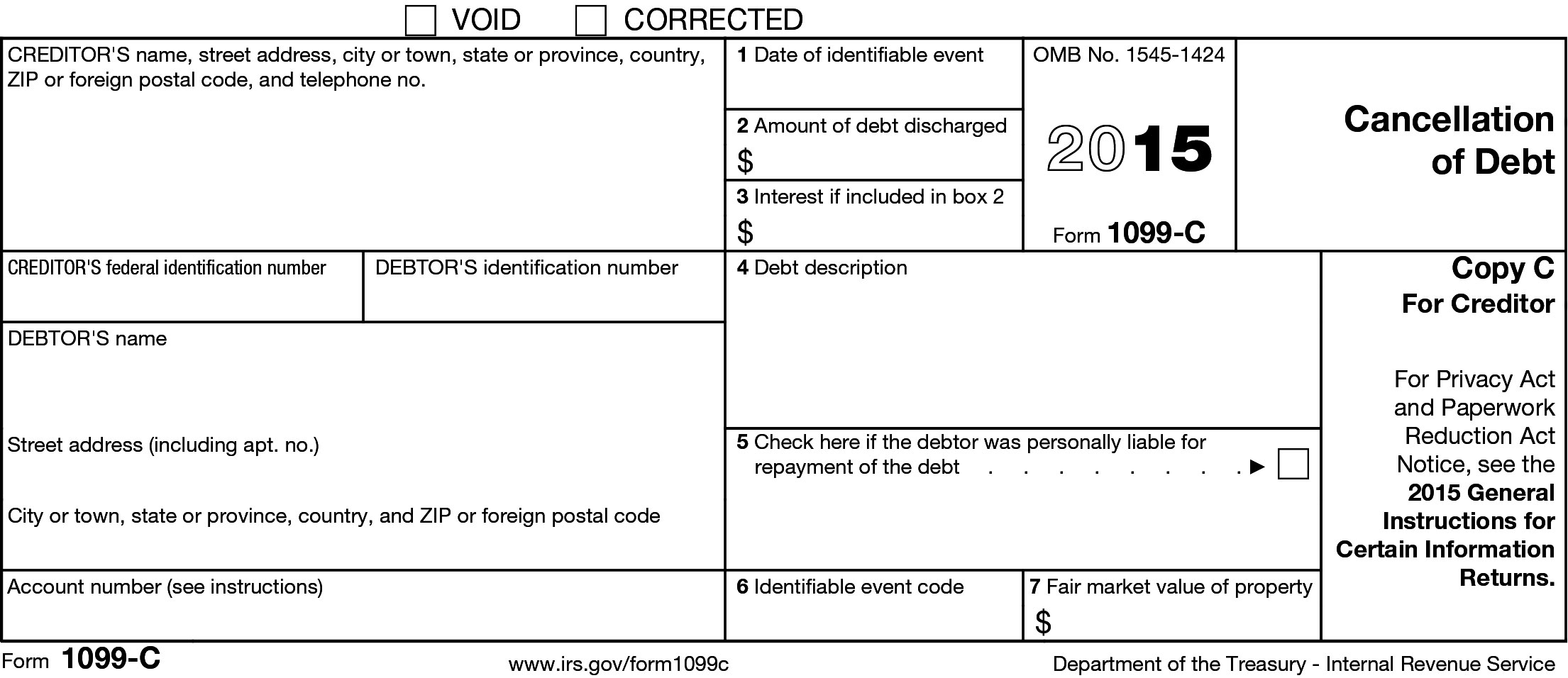

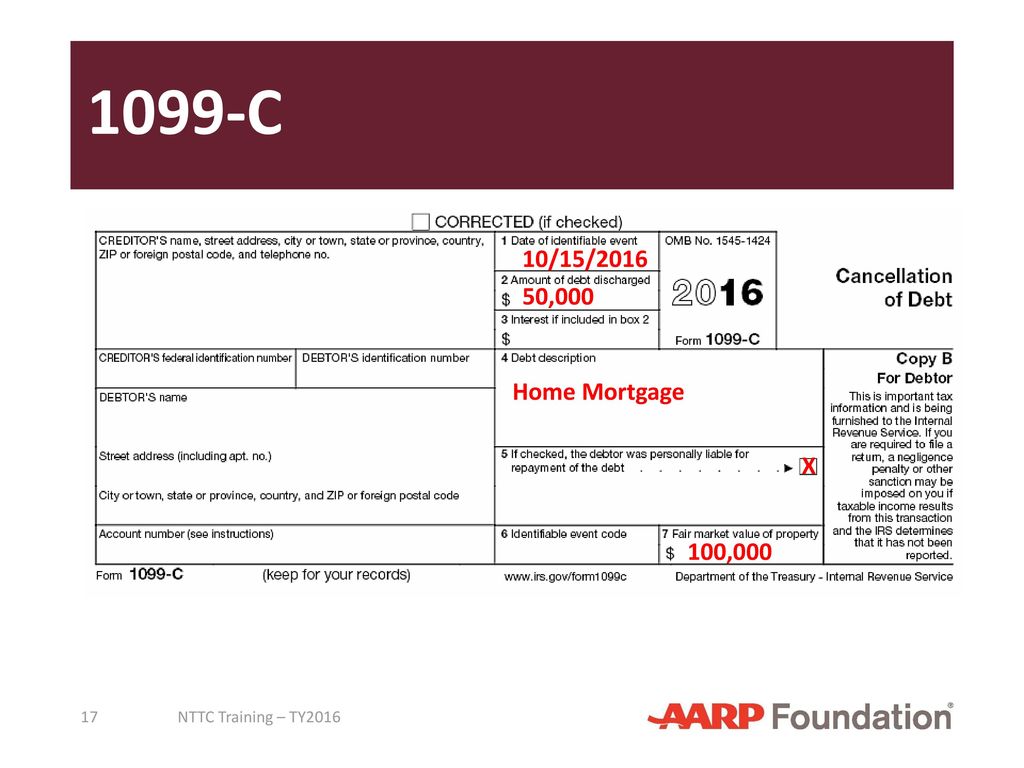

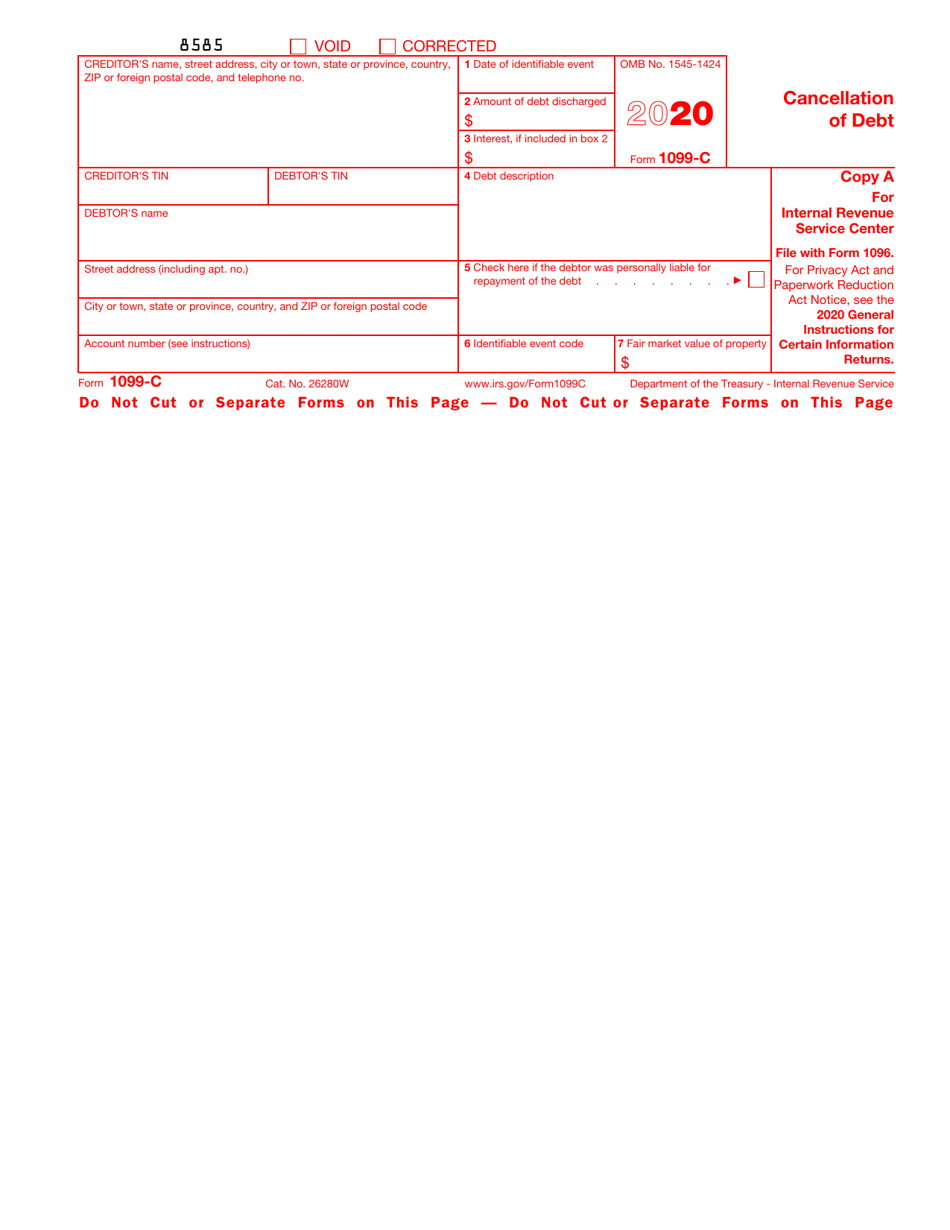

Enter Box 1 (1099A) in Box 1 (1099C) Generally, enter Box 2 (1099A) in Box 2 (1099C) However, if the amount of debt canceled is different from the amount reported in Box 2 of your 1099A, enter the amount of debt actually canceled Your lender can tell you this amount Enter any accrued interest that was canceled in Box 3 (1099C) Form 1099C reporting requirements only mandate that a small number of entities file the form but the application of the form is much greater Any individual or entity can file the form voluntarily to ensure tax compliance by all parties This is becoming more important as more entities are forgiving debts now more than everIf your lender agreed to accept less than you owe for a debt, you might get a Form 1099C in the mail Alternatively, your lender might automatically discharge the debt and send you a Form 1099C if it's decided to stop trying to collect the debt from you

Www Irs Gov Pub Irs Prior I1099ac 12 Pdf

1099 contractor form

1099 contractor form- 1099C tax surprise If a debt is forgiven or canceled, the IRS requires lenders to issue a 1099C tax form to the borrower to show the amount of debt not paid The IRS then requires the borrower to report that amount on a tax return as income, and it's often an unpleasant surprise 6 exceptions to paying tax on forgiven debtThe Internal Revenue Service Form 1099C reports the cancellation of a debt Any creditor or lending agency that forgives or cancels a debt of more

Forms 1099 A And 1099 C Which Form To File For Loan Transactions

The IRS requires that all income and deductible expenses are reported by businesses and individuals or penalties could applyForm 1099C is used to report the cancellation of a debt Why do I file 1099C?Data, put and ask for legallybinding electronic signatures Get the job done from any gadget and share docs by email or fax

Follow these steps to report a 1099C Cancelation of Debt Go to Screen 141, SS Benefits, Alimony, Miscellaneous Inc Scroll down to the Alimony and Other Income section Enter the "Cancelation of debt (1099C)" code 6 under the Cancelation of DebtForm 1099C is received when a debt (home, credit card, student loan, etc) is cancelled When this happens, it means that you received money when the debt was initially incurred, but you never had to pay it back Because you are not paying the debt back, the IRS considers the original debt to be income, and it must be reported on your return IRS Form 1099C is an informational statement that reports the details about a debt that was canceled You can expect to receive the form from any lender that has forgiven a balance you owe, no longer holding you liable for repaying it

What is a 1099C?Unless you're fluent in tax form lingo, all these numbers and letters can get confusing That's why we turned to a professional for some clarityThe Form 1099C instructions identify who must issue the form The list includes financial institutions, credit unions, and organizations whose significant trade or business is the lending of money Can someone other than the above issue a Form 1099C for an uncollectible amount?

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

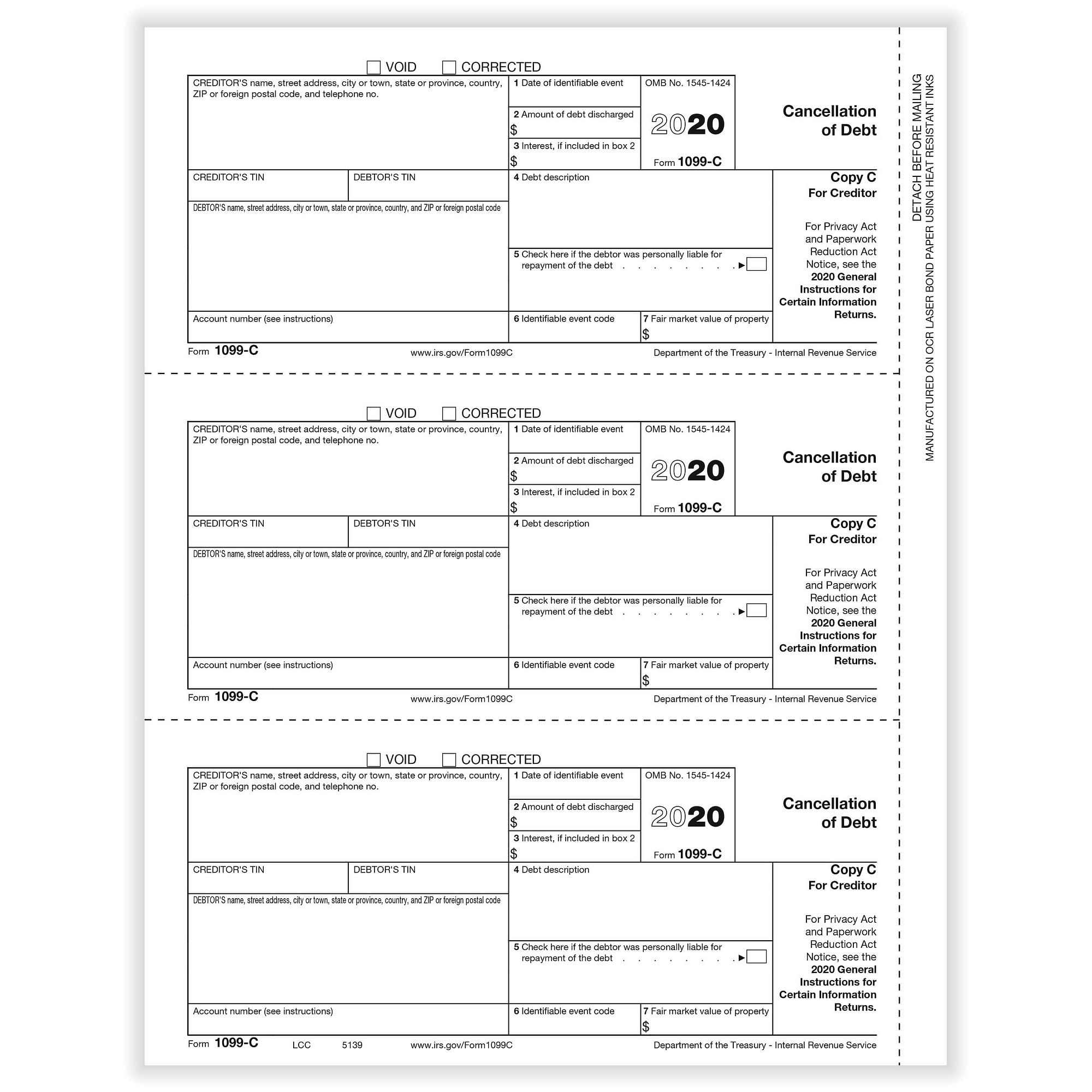

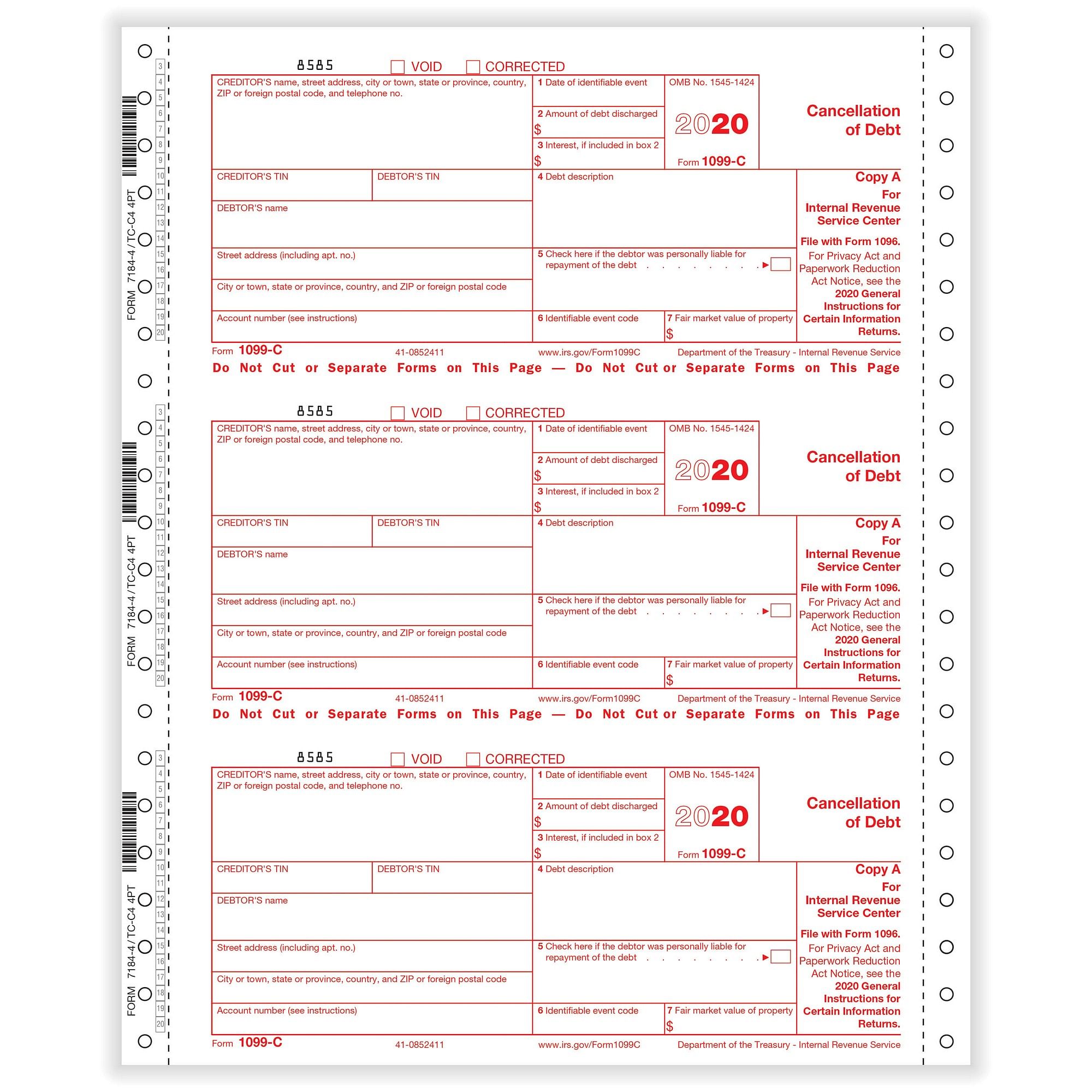

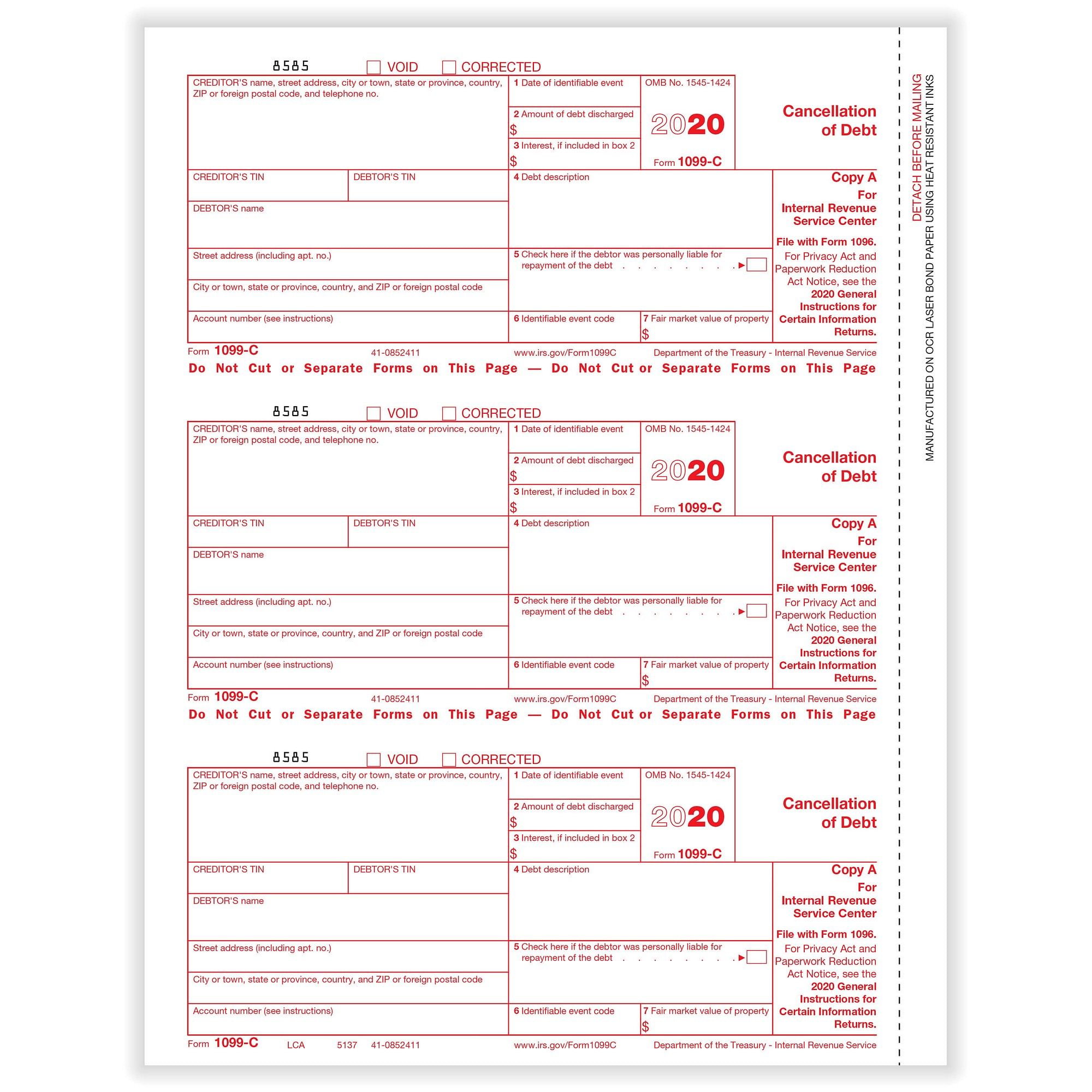

Office Paper Products Forms Record Keeping Supplies 13 Irs Tax Form 1099 C Single Sheet Set For 3 Debtors Carbonless 3 Part

A form 1099C, Cancellation of Debt, is issued by a creditor when a debt is discharged for less than the full amount you owe following an identifiable event and that amount is $600 or more (you Form 1099C is a tax form required by the IRS in certain situations where your debts have been forgiven or canceled The IRS requires a 1099C form for certain acts of debt forgiveness because it considers that forgiven debt as a form of income1099C Disputes Creditors who cancel a debt of $600 or more are required by law to report the debt discharge to the IRS by filling in a 1099C and sending a copy to the debtor This is worth repeating Creditors, not the IRS, send 1099Cs They can write whatever they want on that form

What A 1099 C Is Youtube

1099 Div Form Copy C Payer Discount Tax Forms

The 1099C is used to report the cancellation of $600 or more in debt owed to you by an individual, corporation, partnership, trust, estate, association or company A debt is any amount owed to the organization what is below, including stated principal, stated interest, fees, The Tax Rate When Filing Form 1099C Form 1099C is an income information form that a lender will send both you and the Internal Revenue Service (IRS) if it cancels or forgives a debt that you owe The taxation of Form 1099C income depends on a number of factors, including why the lender issued you the form and your Start by trying to get the company that issued the 1099c to correct it, advises Scott Tufts, a board certified tax lawyer with the Tufts Law Firm in

Solved Re Do I Have To Claim Insolvency This Year In Ord

Irs Forms Handbook 1099 A And 1099 C Mcglinchey Stafford Pllc

Video below explaining the 1099C canceled or forgiven debt IRS rule Form 1099C If a federal government agency, financial institution, or credit union cancels or forgives a debt you owe of $600 or more, you will receive a Form 1099C, Cancellation of Debt The amount of the canceled debt is shown in box 2 of the IRS form1099 c tax calculator Take advantage of a electronic solution to develop, edit and sign documents in PDF or Word format online Convert them into templates for multiple use, include fillable fields to collect recipients? Most people are in for a surprise when they receive a 1099C, never realizing that canceled debt is often treated just like any other dollar of ordinary income Creditors record canceled debts on a

Business Concept About Form 1099 C Cancellation Of Debt With Phrase On The Page Editorial Photo Image Of Document Economy

1099 Int Payer Copy C Or State

You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt Common examples of when you might receive a Form 1099C include repossession, foreclosure, return of property to a lender, abandonment of property, or the modification of a loan on your principal residence Mortgage forgiveness debt relief act A 1099C is used when you have debt canceled or forgiven When will I get a Form 1099C?The 1099C for Debt Cancellations Debt cancellations prompt the issuance of a 1099C in most cases When a debt is canceled, no money is actually made by the individual But the IRS does treat it as taxable income This occurs when a creditor who is owed by a person cancels all or a part of a debt that is outstanding

Tax Season Tribune

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Exclusions and Exceptions to 1099C Many people every year receive 1099C form in the mail and have no idea what to do with it For starters, don't ignore it 1099C is a Cancellation of Debt form that every creditor who forgives (cancels) aEnter this information in the 99C screen If the amount is a discharged debt that is excludable from gross income, it should also be reported on Form 9 What prompts most people to report COD income or tips the IRS off to its presence is Form 1099C Various financial institutions, such as banks, are required to

Johngoldhamer Com Workshops Validating Verifying And Disputing Irs Form 1099 Income Pdf

1099 C Cancellation Of Debt Creditor Or State Copy C Cut Sheet 500 Forms Pack

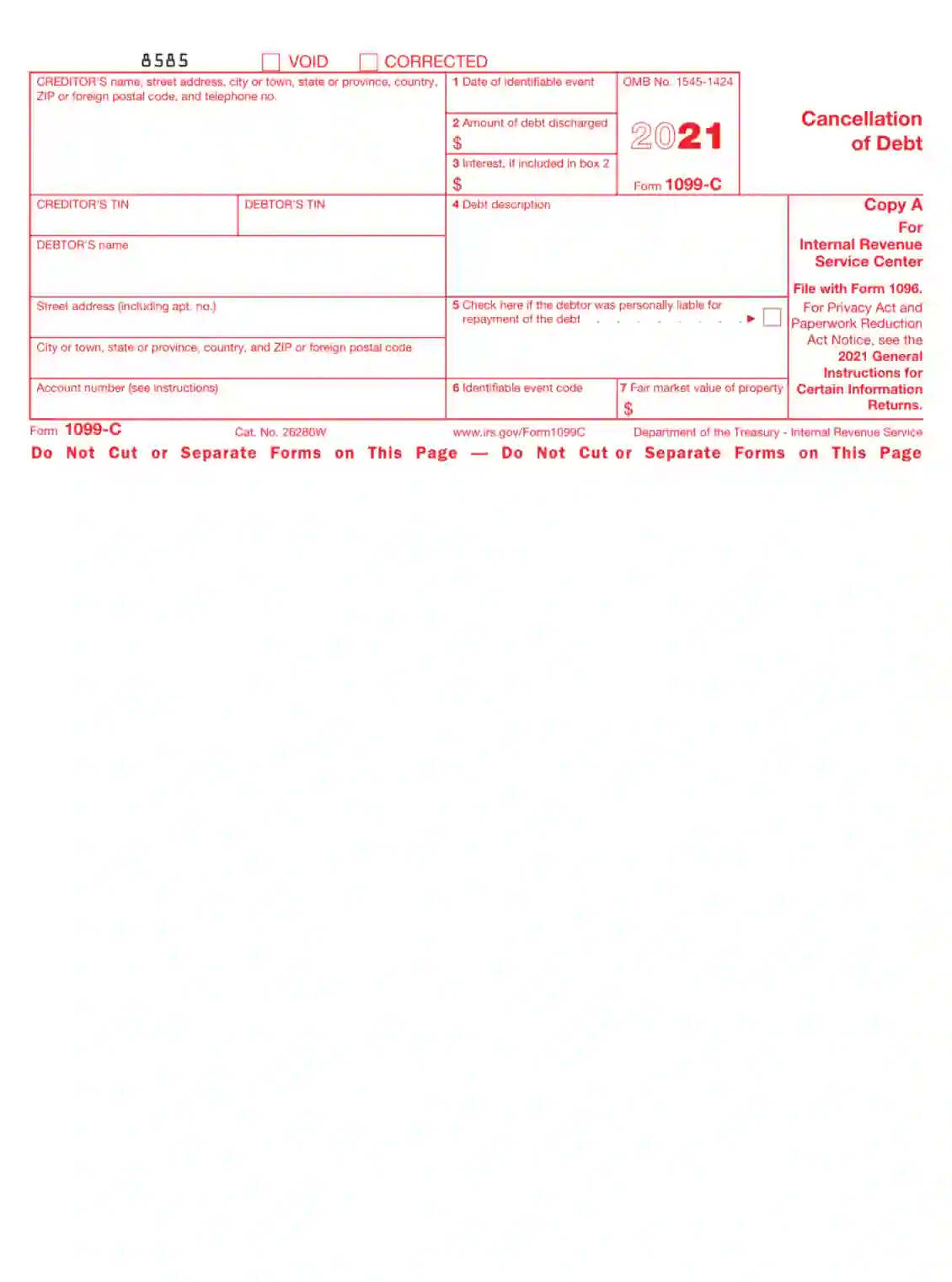

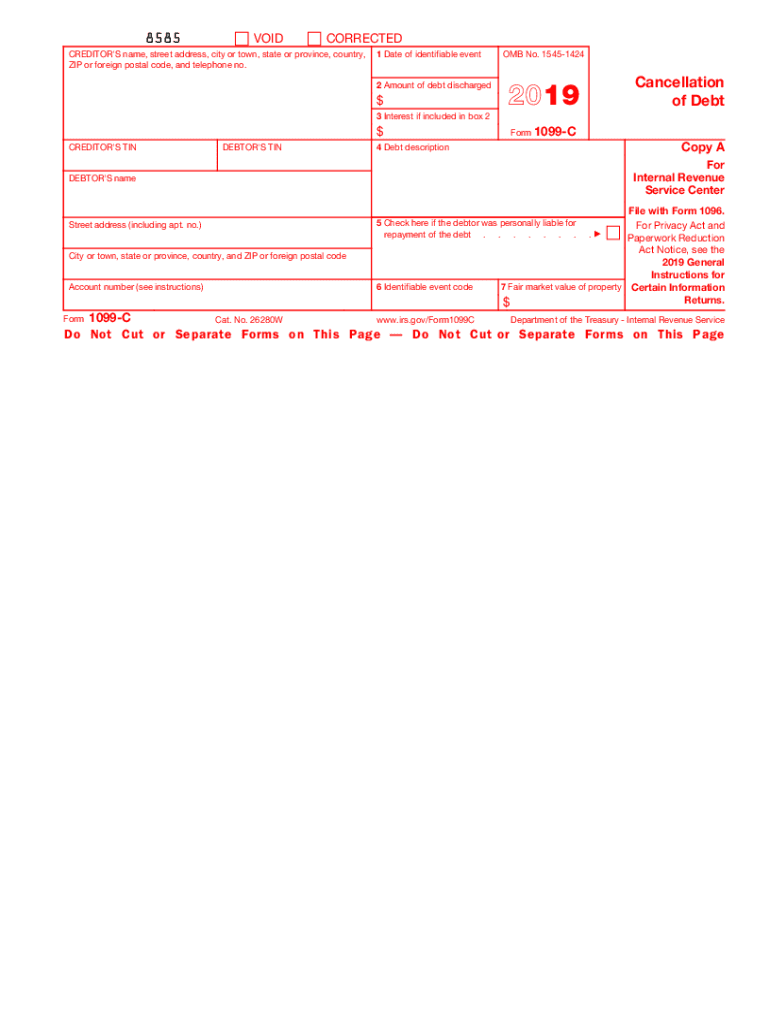

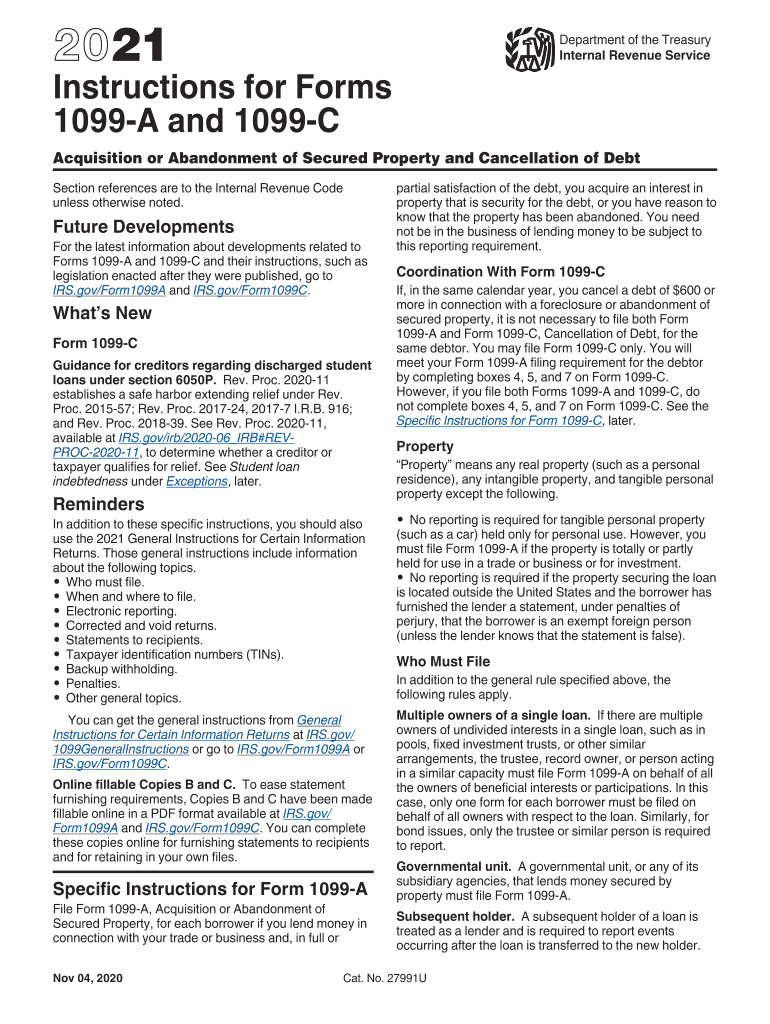

C Form 1099 Fill out, securely sign, print or email your 1099c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a13 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 12 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of DebtForm 1099C, Cancellation of Debt Tax Dictionary You received this form because a Federal Government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven) a debt you owed, or because an identifiable event has occurred that either is or is deemed to be a discharge of a debt of $600 or more

/paying-medical-debt-with-credit-card-999e507c2a4f4580a71db69b6269377c.jpg)

What Is Irs Form 1099 C

New No Box Auburn 1099 C Ceramic Terminal Connector For Si Ser Igniters D8 1 5 Industrial Surplus Direct

And if a 1099C arrived in the mail, you're going to need that, too What is a 1099C? Yes, you have to file a 1099C if you received one(The IRS gets a copy of the form and will sooner or later send you a letter to collect tax due (if any), penalties and interest You don't want this) Code G states that the 1099C was issued because of a "decision or policy to discontinue collection" What is a 1099C form?

Why Did I Receive Form 1099 C Cancelled Debt

Inspirational 1099 C Form 17 Models Form Ideas

About Form 1099C, Cancellation of Debt File Form 1099C for each debtor for whom you canceled $600 or more of a debt owed to you if You are an applicable financial entity An identifiable event has occurred Losing your 1099C Form You can simply contact your creditor and request another copy of your 1099C form Receiving A 1099C Form For An Old Debt Note that 1099C forms don't fall under the statute of limitations Hence, you can still receive a 1099C form for debts you have gotten ages agoForm 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wages

What To Do If You Get A 1099 C Visual Ly

What Is An Irs Schedule C Form And What You Need To Know About It

A 1099C is a tax form that the IRS requires lenders use to report "cancellation of indebtedness income" This form must be filed in certain circumstances where more than $600 in debt is cancelled, or goes unpaid for a certain period of time The lender files this form with the IRS and a copy is supposed to be sent to the taxpayer as wellA form 1099C is a tax document used to report a debt of more than $600 when it is canceled by the lender The lender creates and mails this form to the debtor The debtor reports the amount from the 1099C because they are liable for the taxes that may be owed on that amount A 1099C is a cancellation of debt form filed with the IRS by a creditor that has either 1) reached a settlement with a debtor for less than was originally owed, or has 2) forgiven the entire debt, concluding it will never be able to collect the debt What Sort of Debt Qualifies for Inclusion on a 1099C Form?

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

3

A 1099C reports Cancellation of Debt Income (CODI) A lender is supposed to file a 1099C form if it "cancels" $600 or more in debt It files a copy with the IRS and is required to1099C Cancellation of Debt and Form 9 Last Year 1040 Individual Data Entry Where in the software would I enter a Cancellation of Debt, Form 1099C?The 1099C exists because many unscrupulous people over the years have found ways to use debt forgiveness to avoid paying taxes Also, there is the general idea that if you don't have to pay something that you legitimately owed, then you are receiving

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 C Tax Form Copy B Laser W 2taxforms Com

A Form 1099C is received when a debt (home, credit card, student loan, etc) you had is cancelled This happens when you receive money or goods but, due to circumstances, are not required to pay all or a portion of the amount back to the borrower (debt was cancelled)A 1099C form is a tax form that you may receive if you've had a debt forgiven However, sometimes a creditor or debt collection company may still try to collect on a debt on which you received the formIf you have questions about reporting on Form 1099C, call the information reporting customer service site toll free at or (not toll free) Persons with a hearing or speech disability with access to TTY/TDD equipment can

Www Irs Gov Pub Irs Prior I1099ac 12 Pdf

Understanding A 1099 C For Your Student Loan Debt

Receiving a 1099C should always mean the debt is canceled and no longer subject to collection But it may be up to you to make sure Until 16, IRS rules allowed creditors to file a 1099C if no payments had been made on a debt for 36 months This resulted in many 1099C forms being issued for debts that were delinquent but not actually forgiven Form 1099 is an informational form It is sent out routinely and without much thought on the creditor's part When real property changes hands or when a debt is forgiven, the creditor involved is required to report the transaction to the IRS You, the potentially affected taxpayer, get a copy Here's the action plan to avoid paying more tax The Form 1099C denotes debts that have been forgiven by creditors It is also known as a "cancellation of debt" According to the IRS, lenders must file this form for each debtor for whom they canceled $600 or more of a debt owed to them

1099 C Cancellation Of Debt Understanding Tax On Forgiven Debts Youtube

Form 1099 C When Forgiving Is Not Divine Part One Currytakeaways

If you have a taxable debt of $600 or more that is canceled by the lender, that lender is required to file Form 1099C At its most basic level, a 1099C reports a debt that was canceled, forgiven, never paid back or wiped out in bankruptcy Here are some reasons you may have gotten aInstructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only)

Kaplan And Seager 1099 C Collection Letter Does Not Add Up

Instructions For Forms 1099 A And 1099 C Pdf Free Download

1

I Ve Been Settling My Debt And I M Worried I Might Get A 1099 C

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

1099 Div Software

What Is A 1099 C Why

1099 C Tax Form Copy A Laser W 2taxforms Com

The 1099 C Issue Potential Tax Liability In Debt Settlement And Bankruptcy Az Consumer Law Group

Www Robertsandholland Com Sitefiles News 08 15 13 Can the issuance of form 1099 C cancel a debt Ep Dek Pdf

Cdn2 Hubspot Net Hubfs Docs 1099c form 15 Pdf

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

2

Calameo Irs Instructions For 1099a C

Irs Form 9 Is Your Friend If You Got A 1099 C

Forms 1099 A And 1099 C Which Form To File For Loan Transactions

Outline 108 Cancellation Of Debt Income Pdf Free Download

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

1099 C Form 21 1099 Forms Zrivo

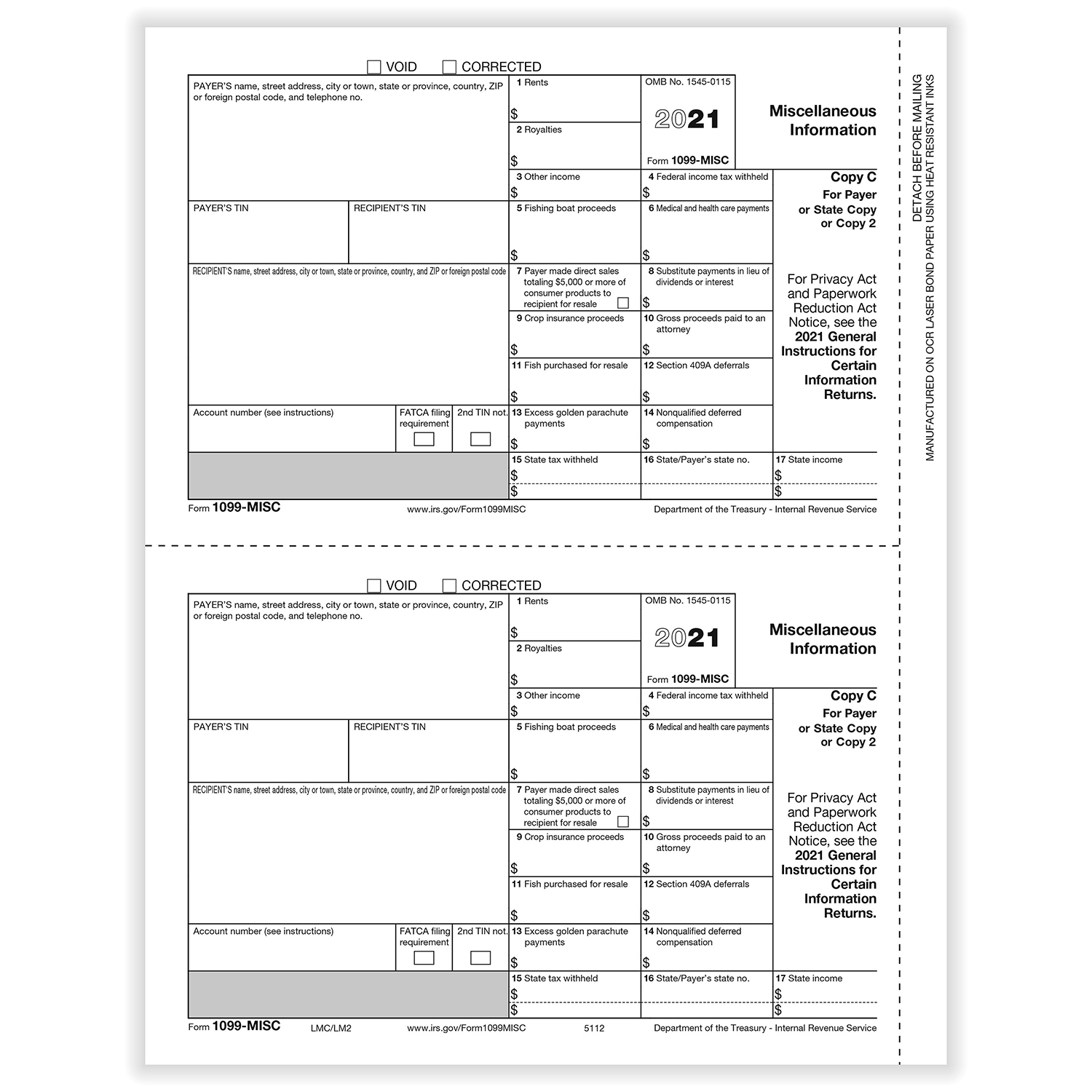

1099 Misc Income Form 1099 Form Copy C 1099 Form Formstax

Irs 1099 C 11 Fill Out Tax Template Online Us Legal Forms

Form 1099 C And How To Avoid Taxes On Canceled Debt Qwest Credit Enhancement Blog Debt Income Tax Income Tax Return

Office Equipment Supplies Carbonless 12 Irs Tax Form 1099 C Single Sheet Set For 3 Debtors 3 Part Business Industrial

Cancellation Debt Photos Free Royalty Free Stock Photos From Dreamstime

Cancellation Of Debt Questions Answers On 1099 C Community Tax

Office Paper Products Forms Record Keeping Supplies 13 Irs Tax Form 1099 C Single Sheet Set For 3 Debtors Carbonless 3 Part

Irs Form 1099 C Fill Out Printable Pdf Forms Online

1099 C Fill Out And Sign Printable Pdf Template Signnow

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

Irs Form 9 Is Your Friend If You Got A 1099 C

1099 Nec Form Copy C 2 Payer Discount Tax Forms

1099 C Cancellation Of Debt H R Block

Cancellation Of Debt Principal Residence Ppt Download

Tafel 1099 C Amillo Graf Marcolini Stadtmuseum Dresden Museum Digital Sachsen

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

1099 C Cancel Of Debt Laser Fed Copy A Item 5137

1099 Nec Form Copy B C 2 3up Zbp Forms

What Is A 1099 C Cancellation Of Debt Form Bankrate

Debtor Copy B Cancellation Of Debt Egp 1099 C 100 Recipients Human Resources Forms Office Products Amaltheiayada Gr

1099 C Cancellation Of Debt 4 Part 1 Wide Carbonless 0 Forms Pack

Fairness Over Deference The Shifting Landscape Of Creditors Rights To Claims And Debtor Protection Regarding The Issuance Of Form 1099 C Pdf Free Download

Child Support Use 1099 C To Cancel The Debt Youtube

1099 C Tax Filing Notice Video Lorman Education Services

Cancellation Of Debt Questions Answers On 1099 C Community Tax

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

1099 Nec Form Copy C 2 Zbp Forms

I Just Got A 1099 C Form For A Debt From 16 Years Ago

Tax Bill Suprise For Old Debt The Irs Is Now On Your Side

1099 C Carbonless 4 Part W 2taxforms Com

Irs Letter To Aca Request For Guidance On Issuing 1099 C To Consumers

1099 C Cancellation Of Debt Fed Copy A Cut Sheet 500 Forms Pack

1099 Misc Form Copy B C 2 3up Zbp Forms

1099 C Surprise Canceled Debt Often Taxable As Income Creditcards Com

2

Irs Form 1099 C And Canceled Debt Credit Karma Tax

1099 C And Debt Forgiveness Harmon Gorove Newnan Bankruptcy Attorneys

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

Should I Be Afraid Of The Irs 1099 C Cancellation Of Debt Form Alleviatetax Com

Will A 1099 C Hurt My Credit Scores Credit Com

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

Is 1099 C Required For Lenders On Forgiven Ppp Eidl Funds Mcglinchey Stafford Pllc

Will A 1099 C Hurt My Credit Score Credit Com

Www Irs Gov Pub Irs Prior I1099ac 13 Pdf

Www Irs Gov Pub Irs Prior I1099ac 15 Pdf

Chase Still Reporting Balance After Issuing 1099c Myfico Forums

Irs Announces Form 1099 C Not Required For Ppp Loan Forgiveness Mcglinchey Stafford Pllc

How Seniors Should Handle A 1099 C

Office Equipment Supplies Carbonless 12 Irs Tax Form 1099 C Single Sheet Set For 3 Debtors 3 Part Business Industrial

What You Need To Know About 1099 C The Most Hated Tax Form

How To File 1099 A And 1099 C In Taxslayer Pro Web Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

1

Everything You Need To Know About Form 1099 A Pdffiller Blog

Schlacht Wahrend Des Ersten Kreuzzug Kreuzzug 1096 1099 C 1490 Artist Sebastian Marmoret Franzosisch Stockfotografie Alamy

Form 1099 C And How To Avoid Taxes On Cancelled Debt Etax Com Blog

Office Equipment Supplies Carbonless 12 Irs Tax Form 1099 C Single Sheet Set For 3 Debtors 3 Part Business Industrial

Form 1099 Misc Miscellaneous Income Payer Copy C

1099 C Debt Cancellation And Your Taxes Explained 19 Youtube

0 件のコメント:

コメントを投稿